#Does nannypay calculate futa taxes full#

To take the burden totally off your shoulders, there are several payroll services available that will handle your nanny’s payroll for you and make sure that you are in full compliance.

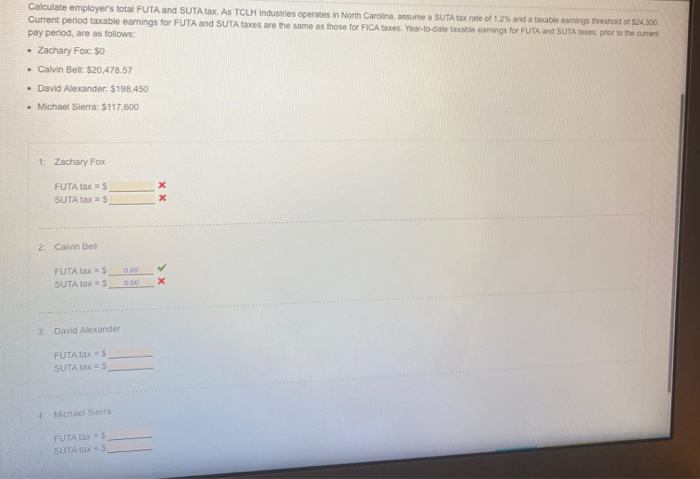

Consulting with your tax profession prior to hiring your first nanny is also recommended. Working with a nanny agency can be helpful, as they are quite familiar with the process and your options. She is also responsible for her own income tax payments, unless you have agreed to withhold these and deposit the payments for her.įor the normal homeowner, all of this can be quite confusing. In addition to these ‘employer taxes’, the nanny will also be responsible for her share of the FICA taxes, which are at a reduced rate for 2011, but will be a matching 7.65% in 2012. Each employer should check on the filing requirements within their own state for these rates and limts. State unemployment taxes may apply, also. This tax is paid on only the first $7,000.00 in wages paid during the year and is calculated at. The other federal tax is referred to as FUTA. Together, they total 7.65% of the nanny’s wages, which you, as the employer, are responsible for paying. This is made up of two parts, social security taxes and medicare taxes. Also, anyone under 18 years old, who is not working as a nanny as their primary occupation, such as a high school student, would be excluded.Īnd what are these ‘nanny taxes’? They are the same taxes all employers must pay into the U.S. Most family members: spouse, parents, or a child under twenty-one would be exempt. There are exceptions to this rule, of course. If you paid more than this amount for in-home daycare during the year, then you are required to report and pay employment taxes on the wages paid to that in-home provider. The first item that you need to consider when deciding whether or not you may owe ‘nanny tax’ is how much money you paid for in-home daycare during the year. The employment tax rules are a bit different for household employees (which is the classification that a nanny fits into), than they are for other employees, so it can be confusing. The term nanny tax originated because of well-known nanny employers who had not paid in the appropriate taxes.

For a detailed breakdown you can look at IRS Publication 926 as it is the Household Employer’s Tax Guide. However, the term nanny tax does refer to some real taxes that employers of nannies do need to pay, just like employers of other types of workers are responsible for paying their share of employment taxes. There are no unique taxes that apply only to nannies. In reality, there is no such thing as a ‘nanny tax’.

#Does nannypay calculate futa taxes how to#

Back to School: How to Help Your Kids Transition.100 Things to Consider before Getting Your Kids Pets.eNannySource is Now Partnering With KIPP.YES Prep Has Become eNannySource’s Newest Partner.Q&A with Jennifer Kuhn of Nanny Magazine.Meet Modern Day Mary Poppins, Candi Vajana, 2017 Nanny of the Year.Congrats to the 2018 INA Nanny of the Year.Announces Strategic Partnership with Knowing Nanny for Better Family and Nanny Matching.Nanny Training Partner Receives CACHE Endorsement.

0 kommentar(er)

0 kommentar(er)